does tennessee have inheritance tax

Does Your State Collect an Inheritance Tax. This is not a loan as we are paid directly out of the estate and the remainder of your inheritance goes straight to you.

The 35 Fastest Growing Cities In America City Houses In America Murfreesboro Tennessee

Get the right guidance with an attorney by your side.

. If your probate case does not pay then you owe us nothing. What You Need to Know About Getting a Tax Identification Number. The most common reason for using a Deed of Variation is to avoid a large inheritance tax bill.

Beneficiaries Heirs and Inheritors The terms used to refer to an individual or group of individuals who can legally inherit according to the law or a will. What You Need to Know About Capital Gains Taxes. Probate The legal process in which the distribution of property is overseen by a court after the death of the owner.

Understanding the various considerations involved can help minimize your tax liability and maximize your May 02 2022 4 min read. Have you inherited a 401k plan. Whats New for 2022 for Federal and State Estate Inheritance and Gift Tax Law.

Protect your brand. If someone dies leaving their entire estate to their partner then when the other spouse dies the family members may be left with a large inheritance tax bill as the first spouse will have effectively wasted their nil-rate band. Last Wills Last Will State Requirements Living Trusts Living Wills Estate Planning Basics Inheritance Cases.

Attorneys with you every step of the way. When it comes to inheriting assets it is important to have an understanding of the terms below. The requirements eligibility and options for proving common law unions within the state.

Common law marriage is a legally recognized marriage between two people who live together without a marriage license or religious ceremony. What State residents need to know about state capital gains taxes. Your credit history does not matter and there are no hidden fees.

Learn more about common law marriages in the state of Tennessee. You can use the advance for anything you need and we take all the risk. A legal document is drawn and signed by the heir waiving rights to.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. There is no obligation. Our network attorneys have an average customer rating of 48 out of 5 stars.

Downtown Gatlinburg Tn I Ve Actually Been In The Pizza Hut Before It Was A Pizza Hut Lol Best Places To Vacation Places To Go Vacation

Tennessee Inheritance Laws What You Should Know Smartasset

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax

Tennessee Inheritance Laws What You Should Know Smartasset

What You Need To Know About Tennessee Will Laws

Where S My Tennessee State Tax Refund Taxact Blog

Historical Tennessee Tax Policy Information Ballotpedia

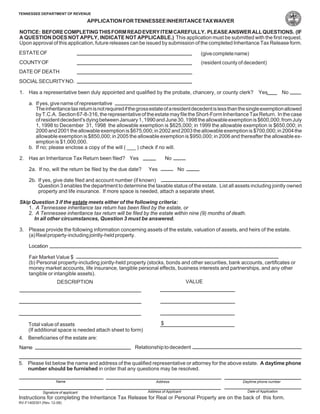

A Guide To Tennessee Inheritance And Estate Taxes

Divorce Laws In Tennessee 2022 Guide Survive Divorce

There Are Several Types Of Power Of Attorney To Consider When Planning Your Estate Contact An Experien In 2022 Estate Planning Attorney Legal Services Estate Planning

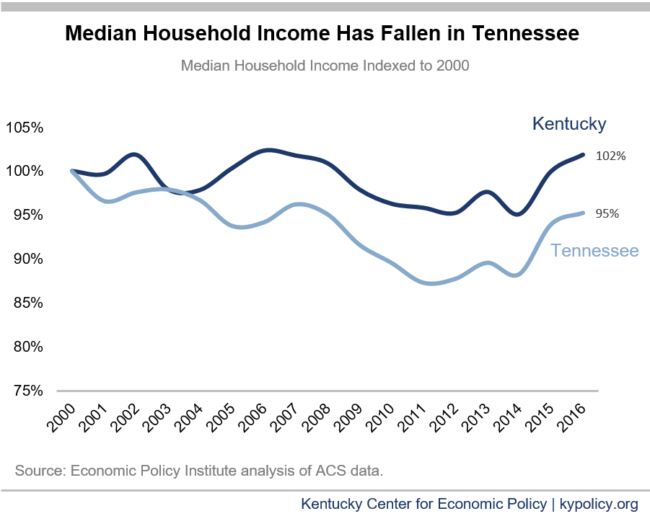

Shifting To A Tennessee Like Tax System Would Harm Kentucky Kentucky Center For Economic Policy

A Guide To Tennessee Inheritance And Estate Taxes

Tennessee Phases Out Inheritance Tax And Repeals Gift Tax Wealth Management

Tennessee Retirement Tax Friendliness Smartasset

How To Get A Marriage License In Tennessee Zola Expert Wedding Advice